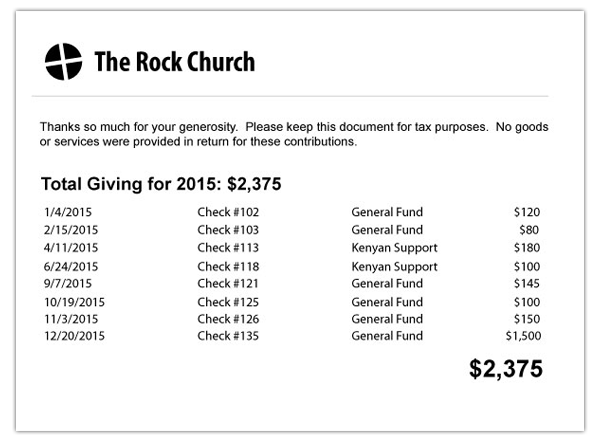

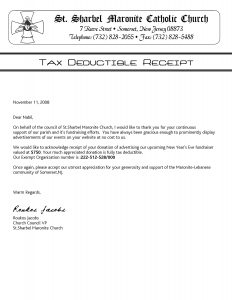

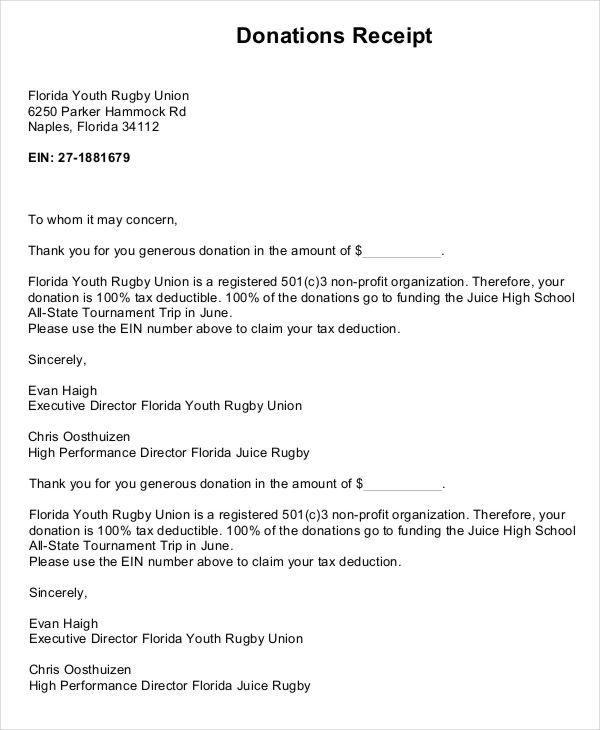

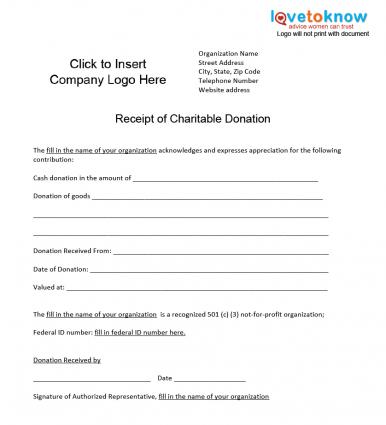

Church Donation Tax Deduction Receipt Template. Normally, in the US, all taxpayers are entitled to a standard deduction, but it changes and varies from one year to another. You can use the church donation receipt template above for any monetary support your parish receives.

When the tax deduction for the donation is more than the income for the year, the existing qualifying donor (i.e. individuals, companies, trusts, bodies of persons) is allowed to.

The church has receipt for the doner's and they should have it to exempt from tax.

You must itemize your tax deductions to claim them You can prepare your own receipt to prove the tax-deductible donation. If you've ever heard someone say "you can write that off," they were likely referring to tax deductions. Donation Receipts free to download, modify and print for your church office to present to their donors.